H

H

|

|

Troubadours and Tax Returns

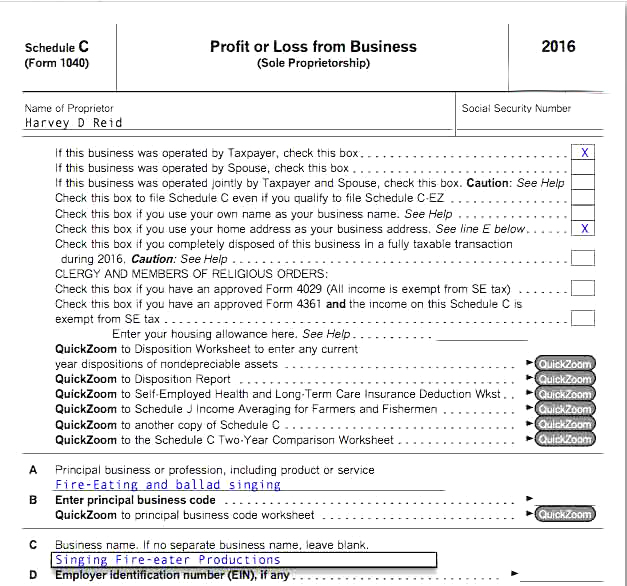

[Note:] Some of my posts on this part of the web site are possibly quite interesting to non-musicians, but this one I doubt will keep many of you fans or "onlookers" riveted. But I could be wrong. Maybe a lot of you have always wondered what we troubadours do at tax time. I often think about how hard it would have been to get a new string for your instrument or to find paper to write some songs on, but at least some things were easier for musicians in the Middle Ages. I'm sure some of the kings and governments put onerous regulations on musicians, but the complexity of the bookkeeping they had to deal with is miniscule compared with what you have to do to be a self-employed musician in the U.S. these days. I've been filing tax returns as a troubadour since the mid-1970s, and hope to pass along some tips, advice & strategy here in hopes of helping out younger troubadours. It's a convoluted, byzantine system and it takes a while to learn what to do. I work hard at it, and I can tell you it's not easy to discipline yourself to keep track of all your transactions as you whiz around being a modern minstrel. If you run any business, you're going to want to keep track of what is going on because by law you are supposed to, and so you know what is going on, and can maybe alter or improve your strategies according to what you learn by looking at your numbers. We artists are supposed to just do our art instead of having a job, but if we do it well, it becomes our profession, and thus we must do the books as all professionals do, or hire someone to do it for us. Even if you are making enough money to hire someone to file your taxes, you're still on the hook to keep track of all the transactions during the year, and that can be tough. We musicians tend to pile up a lot of small transactions in our business lives as we play gigs, sell and give away recordings, and spend money going lots of places and buying lots of real and virtual gear. I'm sure that many musicians ignore their responsibilities as taxpayers and don't file detailed tax returns of their activities, but it can be done, especially since we now all have computers and smartphones that can help a lot with the task. The software they make now is very powerful and easy to use, and a lot of the people you hire are just using software they bought. I use TurboTax. This year the IRS is offering smartphone software so you can file directly with them. I seriously doubt it will be good enough to compete with TurboTax, but we'll see. The perk that you should understand up front that makes it all worth doing is that the tax system actually rewards people who do what they like to do for a living. When you are living the musician life, all your friends, all your activities are often music-related, and there may be very little on your books in the way of "personal" expenses. The classic question "Is this personal or business?" is one we even get asked when we buy a plane ticket. My answer is "both." It's my personal business. Concert tickets, instruments, gear and recordings are all normal business expenses, and old LPs you buy at a junk shop and drinks you order while you are listening to a band are business expenses for musicians. Unfortunately, you're also going to have little incentive to keep track, because it's hard to do and nobody is telling you to do it. The fear of being audited by the IRS plus your own conscience and self-discipline are likely to be the only forces telling you to log everything you are doing in a business-like way. I've been audited by the IRS, and so have a number of my musician friends. Presumably some of the numbers we file are so unusual that they pop us up into "red flag" territory, because they do not blend in with the pack of taxpayers. I've read publications published by the IRS telling their agents how to audit musicians, and though they occasionally haul in small-time artists to see what they are doing and challenge some of their numbers, they apparently love to bust artists who get famous and suddenly make a lot of money after years of living hand-to-mouth with lousy bookkeeping habits. Most artists assume they will get famous some day, so it's a good idea to develop some organized business habits before that happens. When I got audited, they tried very hard to figure out if I was sneaking in "personal trips" and "personal meals." Because I was sleeping in my van a lot and didn't have a lot of hotel receipts, they were challenging my travel expenses as being excessively high, though I was making little money and traveling all the time. I'm sure if I lived in Nashville or Las Vegas where there were lots of musicians my life style would not have looked so odd to a local IRS agent, but in the bleak IRS field office in New Hampshire where I spent most of a day being grilled it was clear that the agent would have loved to go traveling around, and possibly saw what I was doing as "fun" rather than an "ordinary and necessary" expenses for a hard-working business person. The fact that I was going to music festivals and playing gigs in ski resorts and beach towns didn't help the auditor's impression of whether I was actually "working." Places where others go for entertainment are where a lot of the work is for musicians, so it looks suspicious. (I don't ski, because I am afraid of injuries, especially those thumb and wrist fractures.) The IRS tends to lay out the rules of their game very carefully, and there are well-written publications usually called the "Tax Guide for Small Business" that have been very helpful in explaining how they see the difference between business meals or travel and non-business meals or travel. I've always found them very clear and helpful, with lots of examples like: "Jim is a salesman who attends a sales trade show every year. This year he brought his wife along, and they stayed an extra 2 days after the trade show ended. Are her hotel and plane fare tax deductible?" Let's look at some of the basic issues of the situation, then at some details of income, expenses, and I'll try not to bore you, though that danger is always lurking. Some Basic Concepts Business or hobby? Before you start figuring out how to put your business life into IRS forms, you need to face a basic issue. Is what you are doing a business or a "hobby?" It's the first thing the IRS wants to know about you also. You don't have to make a big profit to be "a business" but you need to be aware of the basic guidelines. You can't just go on losing money forever in your business and writing off all those guitars, amps, trips and recording studio costs as business expenses to lower your tax burden from your day job. You can do it for a while, though. If your business makes a profit in 3 of 5 years that's the usual test, though there are a series of "gray areas" where you can push the envelope and lose money for longer periods: You can lose money more than 2 out of 5 years if you do a number of these things: • Show that you are doing business in a businesslike way, which includes doing record keeping and other business processes. • You show a profit motive, and can demonstrate that you are actually working hard trying to make money. • You show that you don't have another source of livelihood. • You can show that what you are doing used to work and you're just in a "slump" or trying something different that is going to work soon. • You can demonstrate a reasonable expectation of a future profit. Many of these tests apply nicely to hard-working but low-income musicians, but I don't think it's wise to buck the IRS rules too much and invite government scrutiny into your bookkeeping unless you have a very good reason. Tax audits are difficult and stressful, and drag on for months. If you have a day job and you pay some income tax and you are trying to get going in your business as a musician, you would be very smart to buy your instruments and PA system during a tax year when you can use a loss at music to get back some of the taxes you paid as a working person. You can do this 3 years in a row if you want, which might greatly help you buy some recording gear, instruments or sound systems you need to get started in music. What kind of a business are you? You basically have 3 choices, though there are numerous sub-categories, as you might imagine, since it is byzantine government paperwork we are dealing with. Most of what I say in this post applies to the sole proprietor kind of business: 1) Sole Proprietor: This is the simplest thing to do, and your social security number is the one you file for your business, unless you apply for an EIN. You should do this, because it is free and easy and is a smart thing to do because more and more organizations who buy things from you or pay you for gigs will demand a tax ID number before they pay you. A small-town library who books you to sing some songs does not need to have your social security number kicking around their office.) You can also file a joint return with your spouse and then both of you become melded into a single tax entity in the IRS system. The downside of sole proprietor situations is that when you die, your business dies too, and it's difficult to pass your thing along as a business entity to someone else to run. You can do business in your own name, or get a "ficticious name" certificate from your state government so people can write you checks to your stage name, for example. 2) Partnership- If you are in a band, you are technically required to file partnership tax returns unless you can somehow argue that you are a group of independent contractors working for themselves. Few bands bother to file formal partnership paperwork unless they are successful or somebody in the band is an accountant or lawyer or is related to one. I find the partnership paperwork to be unreasonably hard to do, and there are a different set of rules and deadlines that apply, which sort of doubles your bookkeeping tasks because you still have to file a form 1040 on tax day like everybody else and keep a lot of your own personal paperwork, plus you have to keep records of each partner's dealings and relationship with the partnership, plus the partnership's own dealings. The fines are pretty harsh for not filing partnership returns on time or making errors. There must be a lot of bands who get into trouble on this issue. The upside of partnerships is that some of my musician friends think that numbers that appear on a partnership return (and then boil down to just a single number of "Partnership Income or Loss" on your 1040) invite less scrutiny and are much less likely to get you audited. Many bands also have the problem of having some "core members" and adding drummers or bass players from time to time. You can file a partnership for just 2 or 3 members of your band, and then treat extra members as though they are independent contractors being hired by the partnership. That way you don't have to dissolve and re-form the partnership every time you switch drummers. If you trademark a band name or co-write songs as a group, you can set it up so only one or a few band members own the intellectual property. It's messy stuff, but also part of the reason why bands who become successful often end up suing each other and breaking up over money issues. 3) Corporation- There are several kinds of corporations, and if you want to incorporate yourself or your band, you'll probably need to get a lawyer and an accountant and explore your options. I haven't done it, so I can't advise you. Usually you become a corporation to shield your assets or protect yourself from liability. Children don't swallow my CD's, and my audiences are not in danger when I perform, so I have never felt the need to become a corporation, though I may be missing out on some perks like having a fiscal year. Income tax vs. Social Security Most low-to-middle-class employees pay in the 10-15% tax bracket, but self-employed people are required to pay their own Social Security, FICA or "self-employment" tax, which more than doubles that. Usually you pay 6.2% and your employer pays another 6.2% to total 12.4%, which is money you never see until you retire or become disabled. Actually self-employed people must pay the 12.4% plus another 2.9% Medicare tax= 15.3% total. If you file a tax return that shows that you made a profit of $15,000 as a musician, you will owe many thousands of $ to the government, even though that number is considered to be around the poverty level of income. If you clear only $6000, you won't owe any "income tax" at all but you will still owe over $900 in Social Security, which means you only made $5000. If you make as little as $400 a year you are expected to pay a 15.3% chunk of that to the IRS! This is why deductible business expenses are a big deal in troubadour bookkeeping. It's more than 1/4 of your income that's at stake. And it's extra bad, because "normal" working people never see the money that goes to FICA because it's withheld from their paychecks. Self-employed people have to be disciplined enough to set aside a big piece of their income to send to the government each year, and sometimes every quarter. It's painful to write those checks, but if you want to be a "successful musician" that's one of the prices you pay, in addition to doing all the paperwork to support all those numbers you have to file on your tax return. What is a "tax deduction?" This is a really important issue, so don't nod off now, please. For most people, what is referred to as a "deductible" expense refers to the concept of "itemizing deductions." This is for people with day jobs and mortgages who make charitable deductions that reduce their taxable income so they get to save money on their taxes as they donate to charity and help the world. When you are a troubadour playing bar gigs and sleeping on couches, this isn't your idea of a "deductible" expense. Let's understand this first. It's one of the very important concepts, and will shape your bookkeeping and possibly even your lifestyle strategy. The thing that determines if you do itemized deductions is how it compares to the "standard deduction," which for 2016 is now $9300. It's a concept in income tax that gives you a break. If you clear $10,000 in your business, they subtract the $9300, and you pay tax on $700. (The bad news is that you still owe 15.3% FICA tax on the $10,000 as we just saw.) Supposedly you have a "business life" and a "personal life." Typically your job or business pays you something, and then you use that income to buy whatever you need to live. Unfortunately, the system is rigged against ordinary working people. The things we spend our money on: rent, food, clothing, cars & commuting to work-- are not considered to be business expenses or tax deductions for employees and working people. You need to understand what that means viscerally. Let's suppose you are a self-employed musician and you go on a trip to Europe to eat gourmet food. If the trip costs you $2000 in plane fare, hotels, meals and other expenses, because you are self-employed and in the 10% tax bracket, you will have to make about $2677 profit, pay about 10% tax + 15.3% FICA = 25.3% in income taxes = $677 to pay for the trip. In order to clear the $2000 to pay for your trip expense you need to make close to $2700 before taxes. But if you were operating a business called "Dining in Europe Magazine," suddenly all those same trip expenses would be business expenses, and a normal part of what you need to do. This would mean that your income from your business would be $2000 lower, which would then save you a little over $500 of taxes you don't pay on that $2000, dropping the trip cost to about $1500 for you. So the same trip might cost out of your pocket $1500 if it were a "business trip" or $2677 if it were a "pleasure trip." These numbers are not hard and fast, but they illustrate the point that you are foolish if you don't put a strong business spin on things you like to spend money on. Plenty of business people do this, and it's not illegal. If you are in the garbage collection business, you likely don't spend your time visiting dumps, watching other people collect garbage, or buying cool antique dumpsters to adorn your office. But as a musician you might want to do all sorts of things that are related to your work, that can easily be argued as ordinary and necessary. This is where it comes in handy to do what you like to do for work. Business expenses are called "above the line" because they come off your gross income number before your FICA tax is calculated. A big thing in IRS auditing is sniffing out "entertainment expenses." They don't like airplane manufacturers to take their clients out to concerts and dinner shows and write them off as "ordinary and necessary" business expenses, and if you do that a lot, you may get hauled in to explain yourself or even fined. But if you are in the entertainment business, it's an ordinary and necessary business expense to go to shows. The airplane manufacturers can write off airplane-related expenses that musicians can't, though admittedly there are more airplane sales people who go to concerts than musicians who buy things for their airplanes. This same multiplier of about 178% applies to every purchase you make: 178% more cost if you spend $500 to buy some non-deductible skis than if you bought an amp or a guitar with that money or went to a music festival. If you have a good year and make some money playing music, you may need to do some fast bookkeeping at the end of the year, and buy a new guitar or amp before Dec. 31, since you are essentially getting a 44% discount. Remember how the numbers work: music gear that would cost a restaurant person or a bus driver $2677 would cost you only $1500 out of pocket because buying the music gear lowers your taxable musician income. Your Tax Year When you run a business, you have the option of creating a "fiscal year" for yourself, where the year begins and ends on a day that is not Jan. 1 It's a good thing to do if you start a corporation, and you can sometimes make your bookkeeping life easier by doing it. (I wish I had.) If you don't declare one up front the first year you file a Schedule C, it's very hard to switch later, and most of us are locked into the Jan. 1 date. I do a lot of concerts in December, and people buy a huge pecentage of everything they buy all year in the month or so before Christmas, so late December is always a hard time for end-of-the-year bookkeeping for me and anyone in the retail business who isn't working on a fiscal year. You have a week after Christmas to sum up the year's income and expenses, and get an idea of how you are doing, and possibly make some last-minute business purchases to get a tax deduction to offset some income. It was a much bigger problem for me in the past, when I sold a lot of recordings, since half the year's receipts came in the last quarter of the year when people bought the most CD's. (Remember when people bought CD's as Christmas gifts? I do.) Which brings up another part of the tax year that comes into play eventually if you get even slightly successful: quarterly accounting. If you are self-employed, no one witholds taxes from your paychecks and you are an "independent contractor." If you start making money in your business, you'll pay some taxes (a lot less if you have young children) and at some point you may get a letter from the IRS that says that it is not good enough for you to pay your tax on April 15, and they want it sooner. This may mean that you have to file Estimated Tax Payments each quarter rather than pay it all at the end of the year, or at least by Jan 15 of the new year to avoid penalties and interest charges. It's pretty arbitrary, but if they say you have to, then you do. Send them $500 on April 15, $300 more on June 30, Sept 30 and Jan 15 with a little voucher-slip they send you, and then the IRS is really happy, and you can maybe work on ways to get them to send some or all of it back to you by claiming lots of deductions. They won't cheat you, and you might get interest on the money you sent early. It's a good strategy to save some of your money during the year and applying it to your taxes, and it seems to send a message to the IRS that you are willing to play the game "properly" and are not trying to hide things. When you do something you like to do for a living and don't make a lot of money, you don't really have to be dishonest like those gangsters and drug dealers. But you have to keep track of what you are doing. Sales Tax Most states have sales tax, and they really don't like it when you are selling things without paying them their share. Your gig income or lessons you teach are not subject to sales tax, but recordings or T shirts you sell are. Web shopping cart software can handle it for you and does not charge tax to people who live in other states if you mail order your products. (Though this landscape is changing, and more states want more sales tax money, even for out of state transactions.) Depending on the size of your business, you usually have a choice or your state will assign you with the duty of making monthly, quarterly, semi-annual or annual payments. When you get into the system, you register yourself as a "reseller" which allows you to use your reseller certificate to not pay sales tax on merchandise that you buy (like CD's or T shirts) that you are re-selling to your customers. That used to have a lot of value back when people bought CD's a lot. Your Tax Strategy Cautious or aggressive return? There are a lot of "gray areas" that are not "black" or "white" and you might have to defend your claim that a trip to Las Vegas was a business trip, for example. This is what the rich guys with good lawyers do. If you get called in to justify these things, it's not as bad as being accused of "fraud" or "tax dodging." The fines and penalties for fraud often involve jail time. If you get challenged on your tax filings, and they disallow something, you don't go to jail, they just lower your deduction, increase your income, and you will have to pay penalty + interest for not paying on time. Unfortunately the IRS always waits 2-3 years or so before they audit you for a particular tax year, so you have little memory of what happened, your papers will likely be disorganized, and so interest penalties will have had time to pile up. If you try to hide significant amounts of income, or don't file a return at all, you can get into real trouble. If your tax return shows 80% of your actual income, you are generally all right, though the IRS has deep roots dating back to Al Capone of tracking criminals by their money trail, and you play hardball with serious professionals if you try to buck the tax system. Everybody fudges a little and screws up some things, since it is complicated and hard to do, but my advice is to try to play the system by the proper rules, and take advantage of as many loopholes and quirks of the tax code as you can. Remember that the IRS rewards you for doing what you love to do as a business. Your Income If you have a job, they usually give you a paycheck, and at the end of the year, your income is the sum of those numbers. If you work for cash, then you have an immediate bookkeeping problem, because your employers usually won't send you an end-of-the-year statement and a W-2 telling you what you earned that year. You'll need to devise or buy a system that logs your income for your performances and your merchandise sales in a way that makes sense to you, and so you can transfer those numbers to your income tax returns when needed. When you get audited, the IRS looks at your life, your bank accounts, and first tries to determine your gross income. It's then up to you to justify deductions from that income as "business expenses," and they need to be documented, and also to pass the various tests of what business expenses are supposed to be. The auditor will also do whatever they can by looking at whatever they can see of your assets and lifestyle to determine if you could have legally bought that car you are driving or living in whatever place you live with the income you are claiming. That's the "sport" for them, and you'll need to pay attention to your own paper trail if you want to play the game differently than they want you to. You use the form Schedule C (Profit or Loss From Business) to show your business income and expenses, and then one final number gets transferred from this to your 1040 on the line where that happens. You'll probably have no choice but to use a computer and some software, because your business life is going to contain a large number of small transactions, and adding them up by hand is not reasonable to do. Where to Put Your Numbers The tax forms are pretty arbitrary, and it is always hard to organize your expenses in a way that's meaningful to you so that they will go into the standard places on the Schedule C. They have a place for "office expenses" "business rentals", "advertising" and "car & truck expenses." In my experience it is pretty random what their categories are, and there is no obvious place to even put postage or royalties paid, let alone stage clothing or concert tickets you bought. Doing Business in Other States For decades, we musicians have been happily touring around, and filing tax returns in only the state we live in. When I lived in New Hampshire, it was really easy, because they had no sales tax and no state income tax. Now things are changing fast, and states need more money, and now they want to know if you are living in one state and working in another. This greatly complicates your tax returns, though there are thresholds, and if you just do a gig or two in a year in a neighboring state you might not make enough money to make them require you to file. Be aware of this, and if you make more than $3000-5000 a year in another state you may need to file a return in more than one state. Those annoying 1099's It's always been the case that when someone gets hired as an independent contractor, there is supposed to be some paperwork filed, and politicians typically get into trouble if they don't file proper IRS paperwork for their maids, gardeners and child care people. The income threshold is absurdly low, and has been at $600 forever, which means if you get paid more than $600 in a year, you supposedly should get a 1099. Certain types of businesses, especially schools and government organizations, have always requested tax ID's from musicians, and send 1099 "non-employee compensation" forms to them in January of every year. If you get royalties from ASCAP or BMI you'll get a 1099 even if you made less than $600, and your bank will probably send one if you made interest income for really small amounts. Since 9/11, there has been a lot of government pressure, especially on non-profit organizations, to always get tax ID numbers and file 1099 paperwork on anyone they pay money to. (This seems to have grown from a suspicion that non-profit Muslim charities were funding terrorists.) So now a much higher percentage of people who pay money to musicians are doing this, and it affects you in several ways. First, you'll get the 1099 forms in January, and if you had plans to hide this income, you'll have problems because the IRS gets the other copy of the form they send you, and they are very fussy about matching up the 1099 forms they get with the ones you show on your return. You'll also probably want to get an EIN (employer identification number, also called TIN= taxpayer id number) so you don't have to send your personal social security number to the bookkeeper of every school, restaurant and library that hired you. It's a simple form, costs nothing, and is much safer. What I do is to get a PDF form from the IRS web site, fill out my name, ID and other info, and save the filled-out form in my computer and phone as a PDF file that I can email instantly to anyone who requests my tax ID information, saving us both the hassle and expense of mailing a form, filling it out and mailing it back. Many of them will complain that the form is not signed, but if you read the fine print of the form instructions, it says very specifically on page 4 that "You must give your correct TIN, but you do not have to sign the certification unless you have been notified that you have previously given an incorrect TIN." The biggest impact of the 1099's is that you now have to painstakingly go through all your income and separate everything into 1099 and non-1099. I now get 1099's from Amazon for online sales I do, and from several other entitites, even if they pay me a small amount of money. The income you claim as non-1099 goes on Schedule C Line 1-a and then each 1099 you get has to be logged on Line 1-b. Your income and tax liability is the same, but it's a half hour or more of precise tallying sometimes to get everything to the penny exactly where it goes so it doesn't set off the IRS red-flag mechanisms. It is no fun, it's tedious, but you have to do it. It also is a real bummer when you play in a band because you might get sent the 1099 for the whole band's income, even though you paid the other members each 1/5 of the money and your actual income was 80% less than the 1099 amount. All the band gigs I do are "pick-up" bands, where we are definitely not a partnership. If your band plays every month at a club and gets paid $500 a night, you might get a 1099 for 6 thousand dollars of income, when you really only made $1200. You might then have to file 1099 forms and send them to all your band members in January to show that it was not all income to you. Your band members will not like this, since they have to do the extra paperwork too. Those darned terrorists have messed up another part of American life. Your Expenses Types of things you can deduct The key phrase that pops up all the time is "ordinary and necessary" business expenses. We musicians need instruments, batteries, strings, amps, cases, music stands, lights, computers, web sites, sound systems and lots of other obvious stuff. We also do a lot of publicity, traveling, promotion and brand-building, which involves a lot of kinds of expenses and activities. It's too big a subject to go into detail on everything, but I'll hilite of few areas where you might have trouble figuring out what to do. Inventory When you sell recordings and T shirts, you are not supposed to just call the cost of making them an expense. There is a calculation on Schedule C called Cost of Goods that compares your Jan 1 inventory with your Dec. 31, and then factors in what money you spent buying and maintaining new inventory to determine the cost of what you sold that year. As far as the IRS is concerned, if you spend $1000 you have in the bank on products to sell, that inventory is the same as money unless you sell it, and all you have done is converted your money into a new form. Unless you are famous, don't count on being able to borrow against it, since banks are smart enough to know that your unsold CD's or T shirts aren't much in the way of collateral for them. Donating your music. If you donate 25 Cd's to a Public Television fundraiser, you don't get to claim their retail value as a deduction for yourself. The money you spent for them will show up when you do inventory at the end of the year, and you'll be able to deduct the cost of manufacturing them. You get little deduction also if you show up at a benefit and perform for free. You might think that because you usually charge $250 to perform that your donation might be worth that. Unfortunately the only thing you can deduct is the mileage for getting there (and that may be a reduced "non-profit" rate) plus any direct out-of-pocket expenses you incurred by doing it, like tolls or parking. Stage Clothing Unless you are in the clothing business, you usually can't write off your clothes as a business expense. However, if the clothing you buy is stage clothing, not "suitable for everyday wear" in your world you can probably call it a business expense. Sometimes that means uniforms you wear to work, or special protective clothing some people wear, and here in my little town in Maine it can mean that I could buy some leopard-print tights and high fringe boots for my concert attire and write off the cost. The grunge band musicians lost out on some deductions by wearing old jeans and flannel shirts on stage. Liberace probably avoided all kinds of taxes by having closets full of wildly expensive diamond-studded clothing that he only wore on stage. Phones & Computers It's never been a "gray area" whether or not record players, amps and other music gear was a business expense, but phones and computers have always been messy, and have sometimes had their own categories of depreciation. For years I called the basic part of my land-line phone service a personal expense, and the long distance part was business. Now that those are bundled together, and also with internet service, so it's not as easy to delineate what is what. Many young musicians now only have a cell phone, and there are few clear built-in boundaries between "personal" and "business" unless we make them ourselves. If you make personal use of the phone as well as business, then you can't justify writing off the entire cost and depreciation of the phone itself and the monthly plan that comes with it as purely business. Some business people even have 2 phones. You might pay $100 a month for a business cell phone, and $20 extra can get you a basic phone for calling and texting your friends and family. (Unless of course they are musicians too.) I use my computers for writing, booking gigs, promoting concerts, video editing, bookkeeping, designing promotional material, album art and web sites, recording albums, shopping for equipment, and I operate a mail order business from my house, so I feel good about declaring my technology to be business-based. I don't have any non-business hobbies that require me to use a computer. Quite the contrary, I am so sick of computers after a work day that the last thing I want is more screen time. If you're unsur, iet's a good idea to assign an estimated business percentage on these items, so that if you are audited or questioned, it shows that you are making a good-faith effort to be reasonable about what you are declaring as business expenses. Everybody understands that phones are business tools as well as personal. Feel free to do some web research on your business computer to help you make up your mind how you want to approach this area. Your time. Nowhere on your income tax forms is there anywere where you account for your time. It's not an asset or commodity, and working your ass off only shows up in your tax forms if you make or spend money on inventory products. If you sell your time by teaching lessons or performing then that's income, but if you donate your time for anything, it's not an expense. Depreciation When you buy a business asset that has a useful life of more than a few years, you are technically supposed to account differently for it than you would for a concert ticket or parking meter. This means that you assign a useful life number of years to it, or fit it into a category like "3-5 years." Of course, you often don't know when you buy something how long it will last or be useful to you, but this is the system we are expected to follow. The idea is that a 5-year asset is something where you deduct 1/5 of it over 5 different year's taxes. This can greatly complicate your tabulating of expenses, especially because there are classes of assets, and byzantine systems of "accelerated depreciation" (MACRS) that are really hard to do if you are a folksinger or a blues guitarist. The odd thing about depreciation is that you can buy something like a vintage guitar, which might actually increase in value, but you still depreciate it as if it had a limited useful life. Not many business assets in the world appreciate in value, and it's possible that under scrutiny by a tax auditor you might need to forfeit depreciation you took or claim a capital gains profit on it if you sell it later for more than you bought it for. If you are a guitar museum or collector you might have to account differently than if you just buy it to be a tool, without the express intent of benefitting from its increasing value. Your car, which becomes your business vehicle if you haven't dedicated a particular vehicle as being entirely for business, can be depreciated by just keeping track of business mileage. Luckily, this means you don't have to depreciate it like a business machine with a 5-10 year life. As long as you do the same thing every year after you acquire a car, you can keep track of the mileage involved for your music business enterprises, and that converts to a % of your yearly miles driven, and you simply assign a total number of business miles. It's now simple to use something like Google Maps to determine the number of miles to any destination if you haven't been good about keeping log books as you drive. The IRS form 4562 for depreciating vehicles is wildly complicated, so be glad that depeciaition is built into the mileage number and you don't have to deal with this form. You simply multiply by the number of business miles to determine your automobile expense deduction. If you buy a building for your business or even repair one, depreciation can be harsh, since you usually have to depreciate your repairs or improvements over 20-30 years. It's no fun to spend $10K on a roof and only be able to write off $400 (1/25 of it) each year for 25 years. Section 179 is a very useful "loophole" that has a weird name and is just a line on your Schedule C, but it's important if you buy gear and instruments. It allows you to expense a certain amount of investment that you made this year, which would otherwise need to be depreciated over various numbers of years. The allowable limit for this has been going up steadily in recent years, presumably under pressure on the IRS from businesses, and it is now at $500,000, which should be enough for any troubadour or jazz musician to buy depreciable gear and write it off on this year's taxes. Ronald Reagan gave us a generous write-off back in the 80s an then it went away, but now it's back. Home office. In some past years, this has been a big issue, and one the IRS has prioritized and cracked down on. It revolves around a couple issues. 1) You need "separate and exclusive" space. This means you can't just sometimes turn your bedroom into a recording studio and then write off a % of your rent. If you have an extra room, and you devote it entirely to your business, that's the right thing to do. 2) The IRS is also concerned about where you do your work, and if you are a plumber, they don't consider that you are doing the major part of your work in your office. Luckily if you write, record, teach, rehearse and store inventory in your home office, you can make a good case that you are doing valuable work there that justifies a home office deduction. As a performer, you do some but not all of your work on stage, and many of us musicians take a modest home office deduction. With a home office, you figure the square footage of your living space devoted to your office and then you can deduct a pro-rated share of the utility, maintenance, property taxes, utilities etc. This can be very a valuable deduction, which is why the IRS likes to crack down on people who abuse it. Travel As I found out when I got audited, travel is what most people seem to think is pleasure and a desirable thing. If you do a lot of business travel, you'll need to keep careful track of it all. This means plane tickets, cab fare, hotels, tolls, rental cars and rental car gas, parking, and whatever else comes in the category of normal and necessary travel expenses. It adds up, and it is hard to keep track of when you are whizzing around. It's a good reason to use a credit card and not cash for things, but that can be hard in a taxi or buying a drink at a concert. Travel meals This is one of the most confusing ones, yet we musicians really do travel a lot and we eat every day. When you are traveling you likely spend more on food than you would at home, and you have the option of keeping track of every meal, or of taking a daily meal allowance. It's currently around $50 a day, though there are insanely complex charts and forms that list different amounts for daily expenses depending on what city you are in, and there are endless discussions in IRS publications of whether they were merely travel meals or actual business meals, and whether you really discussed business during your meals or perhaps were in an exclusively business environment or maybe an unacceptable environment that contained "substantial distractions from business." They mention nightclubs as being unacceptable, but we all know that's where we musicians spend a lot of normal business time. You might eat breakfast in Salt Lake City and dinner in San Francisco, and it's not reasonable to make you reconcile their different meal rates for a single day's meals, so we all end up guessing a lot about what to claim. It's nearly impossible to claim any business travel or meal deductions without feeling like you could be audited and punished for the choices you made. The oddest thing about the travel meal allowance is that after you go to all the trouble of figuring out how many days you traveled and multiplying by the $52 or whatever the rate is per day, then when you put the number in the Schedule C form Line 24-b they instantly take 50% of it away with the so-called "50% deduction." Don't be shocked when it happens. It's also not completely clear what constitues a "travel day" and the IRS goes on at great length about things like their definition of business travel:

They then define the concept of your "tax home:" "To determine whether you are traveling away from home, you must first determine the location of your tax home. Generally, your tax home is your regular place of business or post of duty, regardless of where you maintain your family home. It includes the entire city or general area in which your business or work is located." and then they say things like "If you do not have a regular or main place of business or post of duty and there is no place where you regularly live, you are considered an itinerant (a transient) and your tax home is wherever you work. As an itinerant, you cannot claim a travel expense deduction because you are never considered to be traveling away from home." This IRS double-speak basically goes on forever, and you could spend half your life if you travel a lot just trying to determine what percentage of your income and expenses occurred in various places and how those places relate to your tax home and your tax returns. I've been declaring travel days for years and I still don't know if it's technically a travel day if I leave home at noon, drive 3 hours to CT, play a gig, then drive home and arrive at 3AM to sleep in my own bed. It seems to me that since I spent 15 hours away from home, and may have eaten 3 meals on the road, and I arrive home on a different calendar day, that should count as a whole or at least as a 1/2 travel day. If I sleep over and get home at 11AM after I wake up and drive home then automatically I get a full day deduction. The lines seem blurry to me, though IRS publications seem to be all about not having any blurred lines. Good luck with your music career, and good luck keeping track of it all. If you get successful enough to need to hire an accountant or a gardener, be sure to send them a 1099 form at the end of the year. This is another posting where I'm trying to raise issues, questions and awareness in the world of modern troubadours... You deserve a reward or a door prize for making it to the end. Please check back to look for new posts as I get them done. I plan to cover a wide range of issues and topics. I don't have a way for you to comment here, but I welcome your emails with your reactions. Feel free to cheer me on, or to disagree... Chordally yours, HARVEY REID ©2017

|

A look at the off-stage bookkeeping and paperwork involved in being a modern minstrel.

A look at the off-stage bookkeeping and paperwork involved in being a modern minstrel.